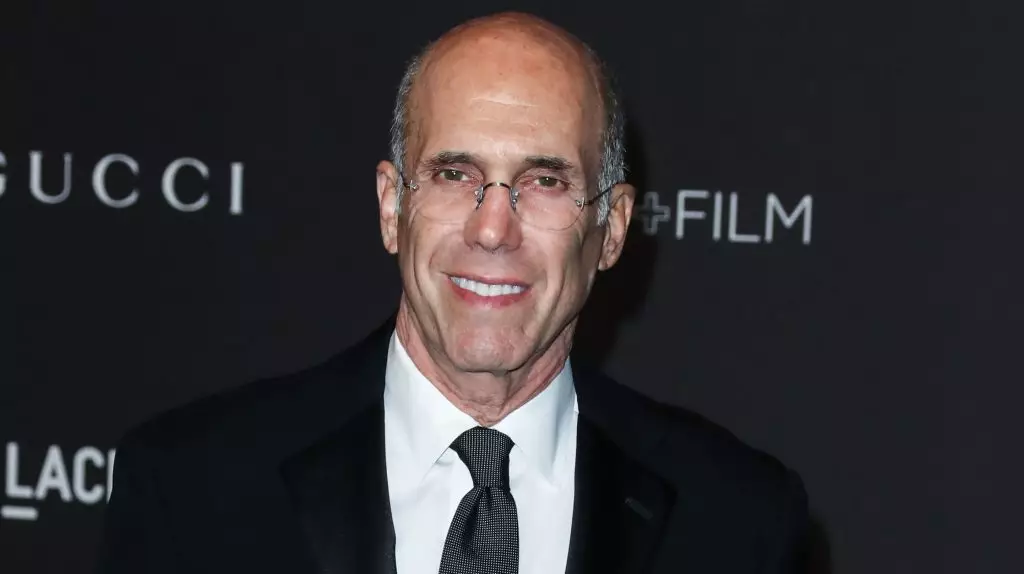

The potential acquisition of Paramount by Skydance has garnered significant attention in Hollywood, with industry veterans like Jeffrey Katzenberg expressing their opinions on the matter. Katzenberg believes that if Paramount were to strike a deal with Skydance, it would result in “a great win for Paramount and for people in the industry.” However, he also acknowledges the complexity of the situation, pointing out that the previous deal with David Ellison did not materialize, despite Ellison’s entrepreneurial spirit and love for the movie business. Katzenberg emphasizes that the economic intricacies and the long-standing history of Paramount make it challenging to achieve a successful outcome but not entirely impossible.

While Paramount continues its negotiations with David Ellison and entertains a competing bid from Sony and Apollo, there are concerns surrounding the latter deal. The Sony-Apollo offer, which includes more financial benefits for shareholders, faces regulatory risks due to Sony’s inability to own broadcast assets. The proposal suggests that Apollo would assume ownership of the broadcast assets, a move that would require approval from the FCC. Katzenberg raises doubts about the regulatory approval process, noting the high bar set by the FCC, especially in the current regulatory environment. This uncertainty casts some doubt on the feasibility of the Sony-Apollo deal.

In addition to the potential deals with Skydance and Sony-Apollo, there remains a third option for Paramount’s controlling shareholders, particularly Shari Redstone. They could opt to maintain the status quo, forgoing either deal and revisiting the possibility of a sale in the future. This scenario would involve Ellison and his backers buying out Redstone’s stake, with a modest additional payout to common shareholders. The company would retain its structure and remain public, a prospect that appeals to certain stakeholders in Hollywood.

The Paramount-Skydance deal and the competing offer from Sony and Apollo have significant implications for shareholders. While the Sony-Apollo bid values the company at $26 billion, including the assumption of Paramount’s debt, shareholders have varying reactions to the potential outcomes. The decision of Paramount’s board to engage with both parties reflects a cautious approach to navigating the offers and determining the best course of action for the company and its shareholders.

As the discussions surrounding Paramount’s future unfold, the industry continues to speculate on the potential outcomes of the proposed deals. Jeffrey Katzenberg’s insights shed light on the challenges and opportunities inherent in the negotiations, highlighting the complexities of the decision-making process. Ultimately, the fate of Paramount rests on the careful consideration of all parties involved, as they weigh the financial, regulatory, and strategic factors at play in determining the company’s future direction.

Leave a Reply